Contents

- Introduction

- Audit of the financial statements

- Commentary on VFM arrangements

- Other reporting responsibilities

Appendix

A. Further information on our audit of the financial statements

1. Introduction.

Purpose of the Auditor’s Annual Report Our Auditor’s Annual Report (AAR) summarises the work we have undertaken as the auditor for North West Ambulance Service NHS Trust (‘the Trust) for the year ended 31 March 2023. Although this report is addressed to the Trust, it is designed to be read by a wider audience including members of the public and other external stakeholders.

Our responsibilities are defined by the Local Audit and Accountability Act 2014 and the Code of Audit Practice (‘the Code’) issued by the National Audit Office (‘the NAO’). The remaining sections of the AAR outline how we have discharged these responsibilities and the findings from our work. These are summarised below.

Opinion on the financial statements

We issued our audit report on 22nd June 2023. Our opinion on the financial statements was

unqualified

Value for Money arrangements

In our audit report issued we reported that we had completed our work on the Trust’s

arrangements to secure economy, efficiency and effectiveness in its use of resources and

had not issued recommendations in relation to identified significant weaknesses in those

arrangements. Section 3 provides our commentary on the Trust’s arrangements.

Wider reporting responsibilities

In line with group audit instructions issued by the NAO, on 22nd June 2023 we reported that

the Trust’s consolidation schedules were consistent with the audited financial statements.

2. Audit of the financial statements

Our audit of the financial statements

Our audit was conducted in accordance with the requirements of the Code, and International Standards on Auditing (ISAs). The purpose of our audit is to provide reasonable assurance to users that the financial statements are free from material error. We do this by expressing an opinion on whether the statements are prepared, in all material respects, in line with the financial reporting framework applicable to the Trust and whether they give a true and fair view of the Trust’s financial position as at 31 March 2023 and of its financial performance for the year then ended. Our audit report, issued on 22nd June 2023 gave an unqualified opinion on the financial statements for the year ended 31 March 2023.

A summary of the significant risks we identified when undertaking our audit of the financial statements and the conclusions we reached on each of these is outlined in Appendix A. In this appendix we also outline the uncorrected misstatements we identified and any internal control recommendations we made.

Qualitative aspects of the Trust’s accounting practices

We reviewed the Trust’s accounting policies and disclosures and concluded they comply with Department of Health and Social Care Group Accounting Manual 2022/23, appropriately tailored to the Trust’s circumstances. Draft accounts were received from the Trust on 27 April 2023 and were of a good quality. The accounts were supported by good quality working papers. In addition, the finance team provided prompt responses to our audit queries.

Significant difficulties during the audit

During the course of the audit we did not encounter any significant difficulties and we have had the full co- operation of management.

Internal Control Recommendations

As part of the audit we considered the internal controls in place that are relevant to the preparation of the financial statements. We did this to design audit procedures that allow us to express an opinion on the financial statements, but this did not extend to us expressing an opinion on the effectiveness of the internal controls. We identified one medium level control recommendation in relation to the Trust’s process for measuring leases.

Other reporting responsibilities

| Reporting responsibility | Outcome |

| Annual Report | We did not identify any significant inconsistencies between the content of the annual report and our knowledge of the Trust. We confirmed that the Governance Statement had been prepared in line with Department of Health and Social Care (DHSC)requirements. |

| Annual Governance Statement | We did not identify any matters where, in our opinion, the governance statement did not comply with the guidance issued by NHS Improvement. |

| Remuneration and Staff Report | We report that the parts of the Remuneration and Staff Report subject to audit have been properly prepared in accordance with the National HealthService Act 2006. |

3. Our work on Value for Money arrangements

VFM arrangements – Overall summary

Approach to Value for Money arrangements work

We are required to consider whether the Trust has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources. The NAO issues guidance to auditors that underpins the work we are required to carry out and sets out the reporting criteria that we are required to consider. The reporting criteria are:

Financial sustainability – How the trust plans and manages its resources to ensure it can continue to deliver its services

Governance – How the Trust ensures that it makes informed decisions and properly manages its risks

Improving economy, efficiency and effectiveness – How the Trust uses information about its costs and performance to improve the way it manages and delivers its services

Our work is carried out in three main phases.

Phase 1 – Planning and risk assessment

At the planning stage of the audit, we undertake work so we can understand the arrangements that the Trust has in place under each of the reporting criteria; as part of this work we may identify risks of significant weaknesses in those arrangements.

We obtain our understanding or arrangements for each of the specified reporting criteria using a variety of information sources which may include:

- NAO guidance and supporting information

- Information from internal and external sources including regulators

- Knowledge from previous audits and other audit work undertaken in the year

- Interviews and discussions with staff and directors

Although we describe this work as planning work, we keep our understanding of arrangements under review and update our risk assessment throughout the audit to reflect emerging issues that may suggest there are further risks of significant weaknesses.

Phase 2 – Additional risk-based procedures and evaluation

Where we identify risks of significant weaknesses in arrangements, we design a programme of work to enable us to decide whether there are actual significant weaknesses in arrangements. We use our professional judgement and have regard to guidance issued by the NAO in determining the extent to which an identified weakness is significant.

Phase 3 – Reporting the outcomes of our work and our recommendations

We are required to provide a summary of the work we have undertaken and the judgments we have reached against each of the specified reporting criteria in this Auditor’s Annual Report. We do this as part of our Commentary on VFM arrangements which we set out for each criteria later in this section.

We also make recommendations where we identify weaknesses in arrangements or other matters that require attention from the Trust. We refer to two distinct types of recommendation through the remainder of this report:

- Recommendations arising from significant weaknesses in arrangements

We make these recommendations for improvement where we have identified a significant weakness in the Trust arrangements for securing economy, efficiency and effectiveness in its use of resources. Where such significant weaknesses in arrangements are identified, we report these (and our associated recommendations) at any point during the course of the audit. - Other recommendations

We make other recommendations when we identify areas for potential improvement or weaknesses in arrangements which we do not consider to be significant but which still require action to be taken

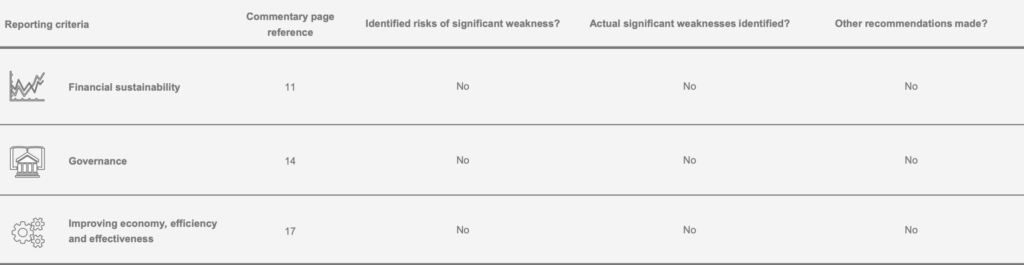

The table on the following page summarises the outcomes of our work against each reporting criteria, including whether we have identified any significant weaknesses in arrangements or made other recommendations.

3. VFM arrangements – Overall summary

Financial Sustainability

How the body plans and manages its resources to ensure it can continue to deliver its services

Overall commentary on the Financial Sustainability reporting criteria

Background to the NHS financing regime in 2022/23

During the course of the year, and into 2023/24, the focus of the funding regime has shifted from responding to the immediate challenges caused by COVID-19 to supporting recovery across the healthcare system. This has facilitated the need for collaborative working between commissioners and service providers, as local systems were expected to work together to deliver a balanced position in 2022/23, with additional funding available for those systems exceeding target activity levels through the Elective Recovery Fund. The planning guidance for 2022/23 supports the transition back to local agreement of contracts, and requires systems to achieve a break even position each year. This will necessitate further collaboration through the planning process, as individual organisations work together to achieve system-level outcomes.

In 2022/23 all Integrated Care Systems (ICS) across the North West obtained NHSE approval to continue with block contract and local payment arrangements for NWAS Paramedic Emergency Services (PES), Patient Transport Service (PTS) and 111 contracts. Contract income was based on nationally calculated block payments, which has been uplifted for inflation and reduced for the national efficiency target. A number of other top-ups were added including system top-up funding, Covid funding, specific allocation and System Development Funding for NHS 111.

Following the 2022 Autumn statement, NHSE issued two year revenue allocations, for 2023/24 and 2024/25. The priority set out is to recover the core services and productivity, of which ambulance response and reducing ambulance handover is listed as imperative to improve patient safety outcomes and experience. A balanced financial plan has been submitted which includes a £12.2m efficiency target.

2022/23 Financial performance

We have undertaken a high level analysis of the financial statements, including the Statement of Comprehensive Income, the Statement of Financial Position and the Statement of Changes in Equity.

The deficit for the year from continuing operations is reported at £4.29m, compared with a surplus of £0.06m in the 2021/22 year. The deterioration in the financial position is mostly driven by an increase in staff costs, which increased by £25m from £327.7m in 2021/22 to £357.7m in 2022/23. This has been due to a combination of the government pay award of £14.9m and increased recruitment to meet demand. The adjusted financial performance position for the year on a control total basis is reported as a £4.86m surplus (£0.08m surplus reported for 2021/22). This outturn position was ahead of the plan agreed with NHSE in late November 2022.

The adjusted financial performance excludes impairments of £8.85m charged to expenditure. The Trust continues to meet its statutory financial targets, including the duty to break-even, and to operate within the Trust’s assigned External Financing and Capital Resource limits.

The Statement of Financial Position also shows an improved position with total net assets of £102.6m at 31 March 2023 (£102.9m at 31 March 2022). This includes an increase of £21m relating to the introduction of IFRS 16 leases, and corresponding liabilities of £20m.

The Trust’s arrangements and approach to 2023/24 financial planning

As detailed in the opening paragraphs of this section, the financial planning arrangements for 2023/24 are consistent with 2022/23. The Trust needs to submit a financial plan to the Lancashire and South Cumbria Integrated Care System (ICS) that contributes to a break even position for the ICS for the year. As a service provider across the North West, NWAS also works closely with the other ICSs in order to develop its financial plans. The Trust’s Finance team co-ordinates the annual budget process – drawing on input from colleagues across the Trust – with Executive oversight through reporting to Resources Committee and Trust Board. The Trust has actively engaged with the ICS partners on the key aspects of local & ICS system financial and operational planning. The annual planning and budget setting exercise includes the identification and quantification of financial and operational risks. Financial plans are considered by the Resources Committee prior to receiving Board approval. The Board and relevant sub-committees are kept updated on longer term financial modelling assumptions via regular reporting from the Executive Director of Finance. We have seen evidence of this through review of minutes from Resources Committee and full Board meetings

The Trust’s latest submission to the ICS in April 2023 reflected a balanced plan for the year, after allowing for a productivity and efficiency target of £12.2m. This is an improved position from the earlier submission which identified an overall deficit of £3m with an £11.4m efficiency target. In order to achieve a balanced plan the £1m contingency have been removed from plans, £1.2m cost pressures that have been aligned with UEC recovery plans have been removed until the UEC funds are confirmed. The efficiency target has been increased to 2.6% of gross expenditure, this is still below the average across the system. The Trust continues to devote significant resources to working with colleagues across the ICS to deliver a balanced financial position. The Trust understands it’s role within the ICS and the pressures on all partners.

The Trust’s arrangements for the identification, management and monitoring of funding gaps and savings

In recent years the Trust has delivered surpluses and operated within its financial performance measures including achievement of the breakeven duty. The financial plan for 2022/23 included a productivity and efficiency target of £15.5m, which is a £4m increase to the previous year of which 2.2% is recurrent. The Trust reported progress against the target to Resources Committee as part of its regular Finance Reports. By month 12, the Trust had fully achieved its target, including £8.2m of recurrent savings.

The latest financial plans for 2023/24 include a productivity and efficiency target of £12.2m. Initial plans assessed within the Finance Department have identified savings totalling £7.8m to deliver this based on the Finance Department’s assessment of previous business cases and historic areas of non-recurrent savings. This leaves an unidentified gap of £4.3m as at the end of March 2023. However, work to identify the savings schemes to deliver this gap is being progressed and agreed with representatives from across the Trust.

Efficiency schemes that require Quality Impacts Assessments (QIAs) are completed and formally signed off by the Director of Quality, Innovation & Improvement and the Medical Director

Although, at the time of writing this report, there are unidentified efficiencies within the plan, we do not consider this gap to present a risk to financial sustainability.

Based on the above considerations we are satisfied there is not a significant weakness in the Trust’s arrangements in relation to financial sustainability.

Governance: How the body ensures that it makes informed decisions and properly manages its risks

The Trust’s decision making arrangements and control framework

The Trust has an established governance structure in place which is set out within its Annual Governance Statement. This is underpinned by the Trust’s Core Governance Documents. Executive Directors have clear responsibilities linked to their roles and the Board Sub-Committee structure in place at the Trust allows for effective oversight of the Trust’s operations and activity.

The Trust’s Core Governance Documents are reviewed on an annual basis and updated in line with latest best practice. During 2022/23 the Trust’s Standing Orders, Standing Financial Instructions and Scheme of Delegation were subject to review by Executive Leadership Committee and Audit Committee prior to being approved by the Board of Directors. We have confirmed this through our review of Board and committee minutes and papers, and our attendance at Audit Committee meetings.

Financial investment decisions are supported by full business cases and are reviewed by Executive Leadership Committee (ELC). Business cases set out the strategic objectives of the project and include a full option appraisal analysis taking account of both financial and non-financial factors of all options including ‘Do nothing’. Once approved by ELC projects are taken to Resources Committee to allow for scrutiny prior to final Board sign off in line with the Trust’s Scheme of Delegation.

The Trust has adopted a Standards of Business Conduct policy which is aligned to the national model policy. Registers of gifts, hospitality and interest are maintained and compliance with the policy is reported to the Audit Committee on a regular basis.

Key regulatory returns are reviewed as part of the Trust’s governance structure – for example, despite not being a Foundation Trust, the Trust is compliant with the NHS Foundation Trust Code of Governance. The annual self certifications that are legally required to be completed have been submitted.

The Trust has a full suite of governance arrangements in place. These are set out in the Trust’s Annual Report and Annual Governance Statement. We reviewed these documents as part of our audit and confirmed they were consistent with our understanding of the Trust’s arrangements in place.

Based on the above considerations we are satisfied there is not a significant weakness in the Trust’s arrangements in relation to governance.

The Trust’s risk management and monitoring arrangements

Risk management at the Trust is guided by the Risk Appetite Statement which is reviewed by the Board on an annual basis.

The Policy on Risk Management defines several levels of risk registers and sets clear responsibilities for the timing of review of the registers at each level. The culmination of this is the corporate risk register, reviewed by Board on a quarterly basis, and which is integrated into the Board Assurance Framework. The BAF outlines 11 strategic risks linked to the strategic priorities of the Trust. These are linked to the Trust’s Risk Appetite Statement as appropriate. Any risk on the Corporate Risk Register with a score of 15 or more is reported in the BAF as part of regular reporting to the Board.

Our review of the BAF confirmed that each risk is assigned a lead director. The 3 leading risks relate to service delivery and resources. The risk profile, in comparison to 2021/22, has improved, as hospital handover times recovered and the impact of covid reduced. The reporting to Committee is clear and transparent, with a clear demonstration of controls, assurance and evidence in place.

The Trust has in place structures to address the findings of the Manchester Arena Inquiry. An Emergency Preparedness Response and Resilience (EPRR) working group with additional resource being recruited has been established. This reports to the EPRR sub-committee, and to the Executive Leadership committee, which finally reports to the Board. The working group have established action plans for all 14 recommendations the Inquiry attribute solely to NWAS and there is regular monitoring and reporting of the actions to committee up to and including the board. In addition NWAS is required to report updates to the Chair of the Inquiry at specific dates during the year. Today action plans for 6 our of 14 recommendations have been fully implemented with a further 7 which are currently ongoing.

The Trust obtains assurance over the effective operation of internal controls through its internal audit function provided by Mersey Internal Audit Agency (MIAA). Each year the Internal Audit Plan is developed with Trust management and reviewed by Audit Committee to ensure appropriate coverage against the Trust’s strategic risks. Progress against the plan is reported to each meeting of the Audit Committee alongside a report detailing progress made against any critical and high risk recommendations. The work of internal audit culminates in the annual Head of Internal Audit Opinion which for 2022/23 provides substantial assurance over the system of internal controls at the Trust. The Trust also employs MIAA to provide anti-fraud services. The Annual Anti- Fraud Report presented to Audit Committee in April 2023 confirms the level of work that has been undertaken in year and the results of the Trust’s self assessment against the NHS CFA standards for 2022/23.

The Trust’s arrangements for budget setting and budgetary control

The Trust’s budget setting process is based on national guidelines which set out the assumptions and processes in place. The outcome of the Trust’s baseline budget setting process is set out in the previous section.

Budgetary control guidelines are shared annually with all budget managers and formal sign off of the budget is obtained from the budget manager. We have reviewed a sample of budgets and confirmed the budget holder had signed off their budget as approved as part of the budget setting process.

Following consolidation of the individual operational budgets, the Trust-wide plan is taken through the Trust governance process including the Resources Committee and Board of Directors. Our review of minutes confirms this to be the case with papers covering the Trust’s I&E position, statement of financial position, forecast cash and capital expenditure and links into the Trust’s planned efficiencies.

Budgetary control is a continuous process at the Trust. The Trust is required to formally report its financial position and forecast outturn at each month end to NHSE. As part of these monthly returns, and annual planning rounds, the Trust is required to submit a triangulation file which reconciles activity, workforce and finance returns to ensure consistency. We have reviewed an example monthly return alongside the year-end return submitted to NHSE. In each case the return reconciles to the financial position reported to the Resources Committee.

As set out in the previous section the financial position is reported to the Resources Committee each month and includes sufficient detail to allow for effective review and challenge at the senior leadership level.

Regulators – Care Quality Commission (CQC)

The latest full CQC inspection report of the Trust was published in June 2020. The overall CQC rating for the Trust was ‘Good’, with some outstanding practice identified within the Trust and some areas of improvement noted. During 2021/22, the Trust was notified of two “urgent and emergency care” focused pressure resilience inspections in the North West, covering the North Mersey and South Cumbria & Lancashire areas, together with an NWAS organisation review. As part of these reviews, inspectors visited a number of the Trust’s locations during April 2022.

The inspection report was published in July 2022, the inspection kept the rating as Good. The feedback identified areas of good practice and compassionate care, a number of issues were identified around communication between senior leaders, and pressure on ensuring the correct resources where in the right place. The Trust considered this feedback at its Board meeting in September 2022 and the response from the Trust.

The Trust is to continue with the work currently underway on the three CQC recommendations made. Action plans have been drawn up to address the recommendations and these will be monitored via the governance structures in place.

Based on the above considerations we are satisfied there is not a significant weakness in the Trust’s arrangements in relation to governance.

Improving Economy, Efficiency and Effectiveness

How the body uses information about its costs and performance to improve the way it manages and delivers its services

Overall commentary on the Improving Economy, Efficiency and Effectiveness reporting criteria

The Trust’s arrangements for assessing performance and evaluating service delivery

The Board of Directors received monthly integrated performance reports detailing the Trust’s performance against key metrics. The data has been reported on a consistent basis and explanations provided for performance.

- Month 11 has seen a 14% decrease in call volume compared to the prior year, and a 6% reduction in incidents, This is attributed to a reduction in calls relating to flu like or COVID symptoms. Hear & Treat continues at 14.8% ranking 2nd nationally.

- Call pick up performance has improved throughout the year with 95% of calls being answered in 1 second in February 2023 compared to 285 seconds in December 2022. The improvement is driven by the reduction in calls and an increase in recruitment of Emergency Medical Advisers and reduced sickness have contributed to the improving picture.

- Calls which resulted in non-conveyance was 42.9% compared to 39.8% for the prior year, patients were able to be dealt with via hear and treat and see and treat thereby freeing up resources to deal with more patients. The implementation of the NHS Pathways in the year contributing to the improving statistics.

- The Trust was unable to meet any ARP (Ambulance Response Performance) category targets during the year due to issues including hospital turnaround times and industrial action throughout January and February 2023.

Work on hospital handover issues have continued during 2022/23 with all ICBs being requested to appoint a senior lead to lead on hospital handover. A North West Handover Improvement Board has been established with an agreed terms of reference. The board is currently working through a series of plans to ensure handover is discussed at each ICB as a key objective.

Whilst there are performance issues noted, these are not issues isolated to NWAS as a Trust, and are inherent across the Ambulance Trust sector. The issues are being reported to the Board on a regular basis, and action taken to try and address the issues. This is indicative of transparent reporting, and the Trust demonstrates that it is aims to identify the root causes and is able to work both internally and with others in the health care system to improve performance.

The Trust’s arrangements for effective partnership working

NWAS has continued to expand its extensive engagement strategy with multiple stakeholder groups. The Trust now has an established patient and public panel comprising 250 groups covering a cross section geographically, both urban and rural and across the age range, which meets on a regular basis and has continued to do so throughout the pandemic. The Trust continues to aim to ensure there is representation from a cross section of society. Panel members are invited to get involved in the Trust’s activities including opportunities to attend Board meetings, development sessions and Q&A sessions with the Executive.

The Trust has in place a structured format on how they engage with various stakeholders and obtain feedback on PES and 111 services. For example providing regular updates to and briefings to the two elected mayors in the region, on monthly performance statistics and action plans that are being implemented to improve service. Briefings to all hospitals regarding the hospital handover delays and implementing new standard procedures.

The Trust has continued with its engagement of the 72 MPs in the North West. All MPs were written to, and there has been engagement with MPs that have responded to the Trust with concerns about service performance.

Monthly Board stories have been an effective way for service users and staff to tell their stories, and the real impact that NWAS has on end users. These have served to provide ways to demonstrate that there has been learning and improvement in response to incidents.

The Trust’s arrangements for commissioning services

The procurement of all goods and services is governed by the NWAS Board approved Standing Financial Instructions. These set the procurement involvement required based on law and best practice. Procurements cannot commence unless there is an appropriate budget available or approved business case. Depending on value pre-tendering approval is also required. Goods and services over £100k must be compliant with the Public Contract Regulations. The approval process for contract awards over £25k and below £500k is the Head of Procurement reviews all recommendations and endorses the recommendation before they are forwarded to the Director of Finance for final approval and sign off. Awards over £500k must be taken through Resources Committee and approved at Board.

The Trust’s arrangements for commissioning services (continued)

The Trust continues to maintain a contracts database which is used to develop the workplan for the procurement team alongside capital regulations. A process of obtaining quotes, tenders or OJEU tenders is put into action depending on value and based on a comprehensive specification of requirements. Evaluations are undertaken by a panel of subject experts.

Frameworks are used wherever possible and often involve collaboration with other ambulance trusts to deliver economies of scale. For example in the purchase of bulk liquid fuel the Trust used the Crown Commercial Service Framework. For routine purchase of consumables NHS supply chain is used.

Procurement activity is reported to Resources Committee on a regular basis to allow for scrutiny and governance review.

A full waiver process is in place whereby waivers are reviewed and signed off by the Head of Procurement. Director of Corporate Affairs, Director of Finance and Chief Executive. Waivers are reported to Audit Committee for scrutiny on a regular basis. The Trust has set a maximum of 5 waivers per month, in 22/23 this target has been met throughout the year.

Based on the above considerations we are satisfied there is not a significant weakness in the Trust’s arrangements in relation to improving economy, efficiency and effectiveness.

Other reporting responsibilities

Statutory recommendations and public interest reports

Under section 7 of the Local Audit and Accountability Act 2014, auditors of an NHS body can make written recommendation to the audited bodies. Auditors also have the power to make a report if they consider a matter is sufficiently important to be brought to the audited body or the public as a matter of urgency, including matters which may already be known to the public, but where it is in the public interest for the auditor to publish their independent view.

We did not issue any statutory recommendations or exercised our power to make a report in the public interest during 2022/23.

Section 30 referrals

Auditors of an NHS body have a duty to consider whether there are any issues arising during their work that indicate possible or actual unlawful expenditure or action leading to a possible or actual loss or deficiency that should be referred to the Secretary of State, and/or relevant NHS regulatory body as appropriate.

We have not issued a Section 30 referral to the Secretary of State.

Reporting to the National Audit Office (NAO)

The NAO, as group auditor, requires us to report to them whether consolidation data that the Trust has submitted is consistent with the audited financial statements. We reported to the NAO that consolidation data was consistent with the audited financial statements. We also reported to the NAO in line with its group audit instructions.

Fees for our work as the Trust’s auditor

We reported our proposed fees for the delivery of our work under the Code of Audit Practice in our Audit Strategy Memorandum presented to the Audit Committee on 12th April 2023. Having completed our work for the 2022/23 financial year, we can confirm that our fees are as follows:

| Area of work | 2022/23 fees |

Planned fee in respect of our work under the Code of Audit Practice | £72,750 |

Total fees | £72,750 |

Fees for other work

We confirm that we have not undertaken any non-audit services for the Trust in the year.

Significant risks and audit findings

As part of our audit, we identified significant risks to our audit opinion during our risk assessment. The table below summarises these risks, how we responded and our findings.

| Risk | Our audit response | Our conclusion |

| Significant Risk – Management override of controls In all entities, management at various levels within an organisation are in a unique position to perpetrate fraud because of their ability to manipulate accounting records and prepare fraudulent financial statements by overriding controls that otherwise appear to be operating effectively. Due to the unpredictable way in which such override could occur, we consider there to be a risk of material misstatement due to fraud and thus a significant risk on all audits. | We addressed this risk through performing audit work over: Accounting estimates impacting amounts included in the financial statements; Consideration of identified significant transactions outside the normal course of business; and Journals recorded in the general ledger and other adjustments made in preparation of the financial statements. | We have completed our planned work and procedures in relation to the risk and have no issues to report or bring to your attention. |

| Significant Risk – Risk of fraud in revenue recognition. The risk of fraud in revenue recognition is presumed to be a significant risk on all audits due to the potential to inappropriately shift the timing and basis of revenue recognition as well as the potential to record fictitious revenues or fail to record actual revenues. For the Trust we deem the risk to relate specifically to the recognition of income around the year end. | We addressed this risk through performing audit work including; evaluating the design and implementation of controls the Trust has in place over the recognition of revenue; testing of material year end receivables and receipts; testing receipts in the pre and post year end period to ensure they have been recognised in the right year; and reviewing intra-NHS reconciliations and data matches provided by the Department of Health and Social Care and, if necessary, seek direct confirmation from third parties or their external auditors. | We have completed our planned work and procedures in relation to the risk and have no issues to report or bring to your attention. |

| Significant Risk – Risk of fraud in expenditure recognition. The risk of fraud in expenditure recognition is presumed to be a significant risk on all audits due to the potential to inappropriately shift the timing and basis of expenditure recognition as well as the potential to record fictitious revenues or fail to record actual revenues. For the Trust we deem the risk to relate specifically to the accuracy and existence of non-pay accruals, provisions, deferred income and the existence and accuracy of capital expenditure in quarter 4 of 2022/23. | We addressed this risk through performing audit work including; evaluating the design and implementation of controls the Trust has in place over the recognition of expenditure; testing of material year end payables; testing payments in the pre and post year end period to ensure they have been recognised in the right year; and reviewing intra-NHS reconciliations and data matches provided by the Department of Health and Social Care and, if necessary, seek direct confirmation from third parties or their external auditors. | We have completed our planned work and procedures in relation to the risk and have no issues to report or bring to your attention. |

Key areas of management judgement and enhanced risks

| Risk | Our audit response | Our conclusion |

| Enhanced Risk – IFRS 16 ImplementationIFRS 16 has been applicable from 1 April 2022 and is designed to report information that better shows lease transactions and provides a better basis for users of financial statements to assess the amount, timing and uncertainty of cash flows arising from leases. The Trust is required to re-classify a number of lease arrangements in line with this new standard for the first time in the 2022/23 accounts.. | We have reviewed the work that the Trust has carried out for the implementation of IFRS 16 on 1 April 2022.We have substantively tested lease balances and obtained evidence to support that they have been correctly classified and accurately measured under the new standard. | We have completed our planned work and procedures in relation to the area of focus. We identified a control recommendation in relation to the valuation of right of use assets. |